Table Of Content

Our editorial team does not receive direct compensation from advertisers. Last month, the White House unveiled a new student debt relief plan aimed to cancel debt and wipe out runaway interest for millions of borrowers. Instead, you may have to pay for a monthly subscription or a fee to access your funds instantly. You must meet the following requirements to qualify for an FHA loan. When you buy your home with Rocket Homes and Rocket Mortgage, you could save up to $10,000 on closing costs with a 1.5% closing credit. A joint loan is one you get with another person, meaning they share responsibility for payments and can access the funds.

Stay Away From Hard Credit Inquiries

You don’t have to consolidate all of your loans, so you might exclude your FFELP loans if you want to keep your current discount. You’ll need to weigh whether you qualify for forgiveness and how consolidating might affect your monthly student loan payment to decide if consolidating is right for you. Alternatively, a construction-only loan provides flexibility to shop around for lower rates if you need to refinance the loan into a new permanent mortgage. Although, in this scenario, you’ll need to go through the expense and hassle of two closings.

Key Facts About Avant Personal Loans:

You may also qualify for a larger loan amount with a co-signer, even with bad credit, which can give you a bigger budget when shopping for a home. Starting the home buying process with bad credit can make it seem nearly impossible to get a loan, but did you know there’s such a thing as a bad credit home loan? Crafting a budget to find ways to cut expenses or picking up a side hustle to generate more income can help you save for a larger down payment. You should also consider committing any lump sums you receive, like tax refunds or bonuses, toward your down payment. Finally, if you have loved ones who may be willing and able to help, you can always ask them to gift money toward your home purchase.

Conventional Mortgage Credit Score Requirements

A secured loan requires you to pledge collateral — usually a vehicle or bank account — to borrow money. Review the pros and cons of bad-credit loans, and compare them with other ways to borrow money. Mortgage rates change almost daily and can depend on market forces such as inflation and the overall economy. While the Federal Reserve doesn't set mortgage rates, they do tend to move in reaction to actions taken by the Federal Reserve on its interest rates. Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial decisions.

Though it’s difficult to get a mortgage with bad credit, it’s not impossible. In fact, some mortgage types specifically cater to borrowers with less-than-ideal credit. When you’re shopping for a home with bad credit, there are a few steps you can take to improve your chances of approval. USDA loans have different credit score requirements depending on the program and the lender. Section 502 Guaranteed Loans, for example, don’t have a minimum credit score requirement. USDA mortgages are available to low- to moderate-income borrowers who want to buy a home in an area with a population of less than 35,000.

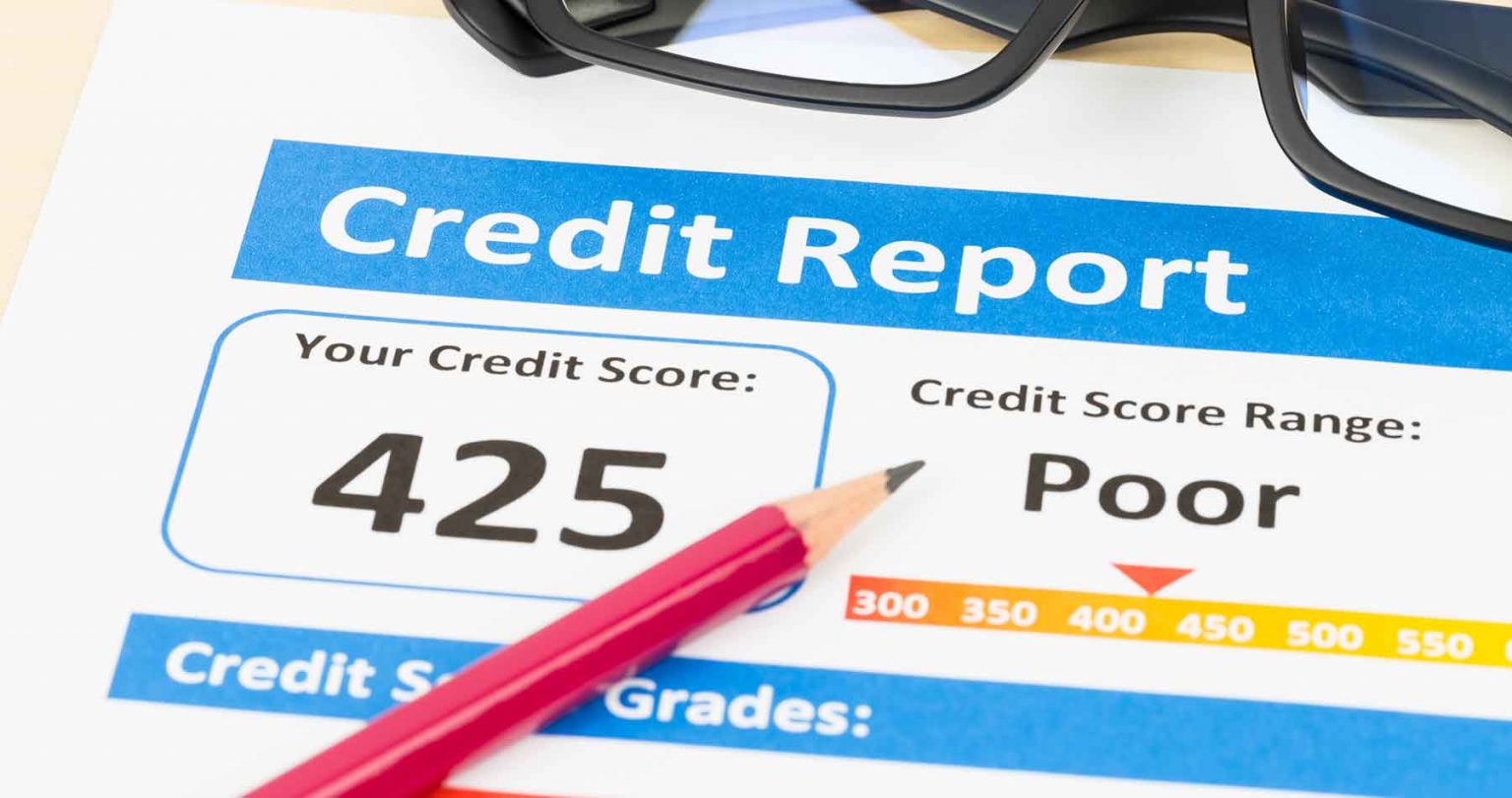

How Is Your Credit Score Determined By Mortgage Lenders?

State-sponsored first-time home buyer programs offer down payment assistance and grants that can enhance your borrowing power. The amount of down payment you'll need depends on what type of home loan you're getting. If you are affiliated with the military, you may be able to qualify for a mortgage backed by the Department of Veterans Affairs. Department of Agriculture and meant to help lower-income borrowers living outside of urban areas, also have no down payment requirement. Fewer lenders offer Federal Housing Administration (FHA) loans than conventional ones. Some lenders will allow you to qualify for an FHA loan with a credit score of 500.

Tennessee First-Time Home Buyer 2024 Programs and Grants - The Mortgage Reports

Tennessee First-Time Home Buyer 2024 Programs and Grants.

Posted: Tue, 23 Apr 2024 07:00:00 GMT [source]

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. On the other hand, the higher your score, the more options you'll have for credit, including home loans. If you're not in a rush, you may be better off taking the opportunity to improve your credit before you apply for a mortgage loan. If you want to buy a home but your credit needs improvement, you may worry that you won't be able to qualify for a mortgage.

Conventional loans come with “risk-based pricing.” That means a lower credit score and/or low down payment directly translates to higher interest rates. Conventional borrowers with bad credit will carry higher private mortgage insurance (PMI) rates, too. Additionally, the lender must offer at least one product or feature that accommodates borrowers with lower credit scores.

What credit score do mortgage lenders use?

Most lenders follow these rules because after they close your loan, they sell it to one of these companies. The table below shows how few borrowers get conventional loans with credit scores below 700. The minimum credit score to get a mortgage depends on which type of mortgage you’re applying for. Some lenders are more willing to work with low-credit-score borrowers than others. You need a credit score of at least 620 to buy a house with a conventional loan.

FHA rates are meant to be affordable for all home buyers, even those with so-so credit histories. Here are five steps you can take during the home-buying process to improve your odds of qualifying for a home loan. Having bad credit doesn’t always mean you can’t enjoy the benefits of homeownership. Instead, it might just require additional research when looking for financing.

Lenders want you to have vast amounts of credit because they know life is unpredictable. When things go sideways for you, those large credit lines can keep you afloat, so you have money to keep paying on your mortgage. If money is tight and you cannot afford to pay all of your bills in full each month, prioritize for minimum payments, at least. Errors are pervasive for renters who’ve changed residences a lot, people who pay or defer on student loans, and men and women who have changed their legal names. If you’ve never applied for a mortgage, you have never seen your mortgage credit report, and more than one-third of credit reports contain errors.

To qualify for a construction loan, Movement Mortgage requires borrowers to have a minimum credit score of 620. The VA backs loans, which is similar to the FHA program in that the VA insures the loan, but a VA-approved lender issues the loan. However, many VA-approved lenders require a minimum credit score of around 620.

Rural borrowers may qualify for a mortgage directly with the U.S. Department of Agriculture (USDA) or through a USDA-approved lender. These loans are available to low- and moderate-income borrowers who live in designated rural areas, typically based on population size. You can buy a home with bad credit and good income because mortgage lenders look at your complete mortgage application — not just one part of it. Minimum credit scores vary among lenders because lenders don’t necessarily care about your credit score.

No comments:

Post a Comment